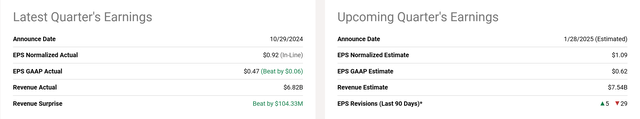

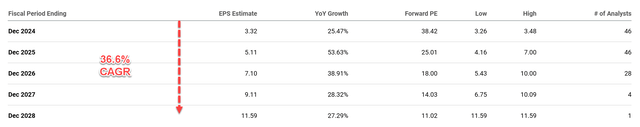

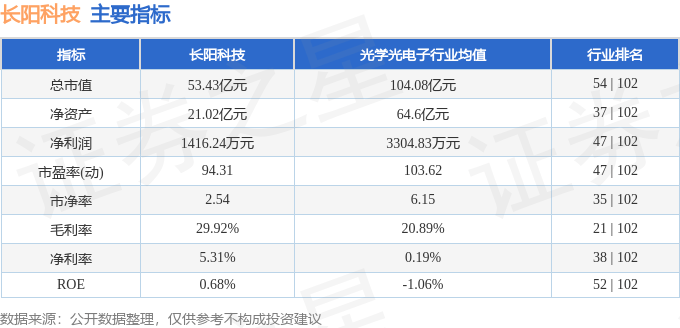

AMD’s strong Q3 earnings, exceeding expectations despite a recent slowdown in AI chip demand, highlight its robust competitiveness in the high-performance computing and AI sectors. This success stems from increased demand in these areas. However, softening demand from key AI clients and advancements in Google’s quantum computing technology introduce uncertainty, prompting analysts to lower their growth projections. Despite these headwinds, we believe current market pessimism has driven AMD’s stock price to an attractive valuation. Based on our five-year earnings projections, its PEG ratio is approximately 1, aligning with GARP (Growth at a Reasonable Price) investment criteria.

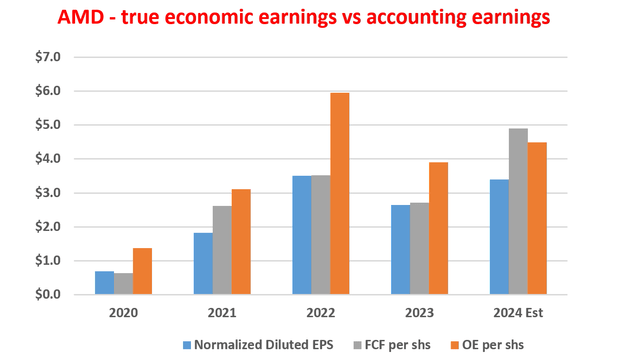

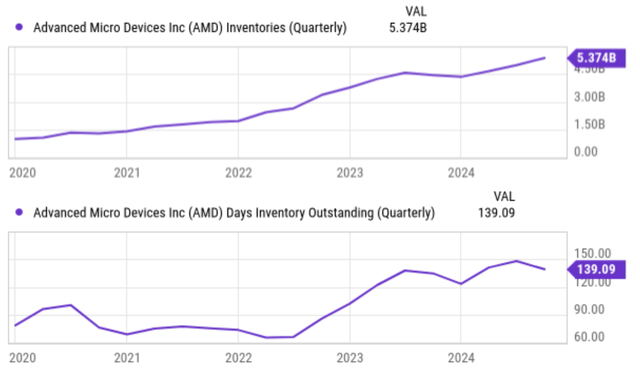

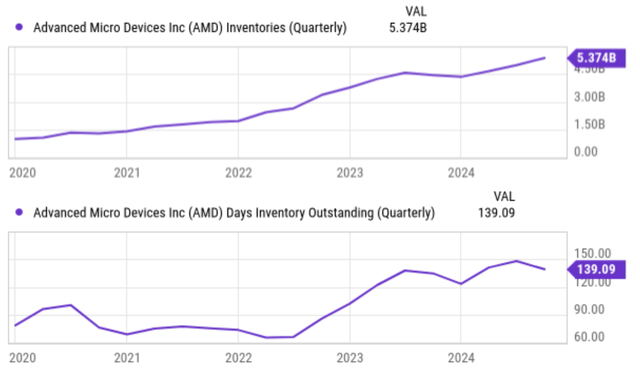

AMD’s fabless model offers a significant advantage. Its light capital expenditures lead to an underestimation of its true owner earnings, as reflected in its reported accounting earnings per share. By factoring in growth capital expenditures, we find its owner earnings significantly surpass its accounting earnings. Furthermore, improving inventory data, with declining days of inventory outstanding, suggests an easing of inventory backlog and a potential upturn in market demand.

While cyclical fluctuations in AI chip demand and long-term risks associated with emerging technologies like quantum computing remain, and competition in the data center market intensifies, we believe these downside risks are largely priced into the current stock price. Therefore, in the prevailing market sentiment, we view AMD stock as a compelling contrarian investment opportunity. Further research into the competitive landscape, specifically the impact of Nvidia and Intel’s offerings, and a detailed analysis of the potential disruption from quantum computing are warranted to further refine this assessment. A sensitivity analysis examining the impact of varying levels of AI demand on AMD’s future performance would also add valuable context. Finally, an in-depth look at AMD’s technological roadmap and its capacity to adapt to evolving market dynamics is crucial for confirming the long-term viability of this investment.