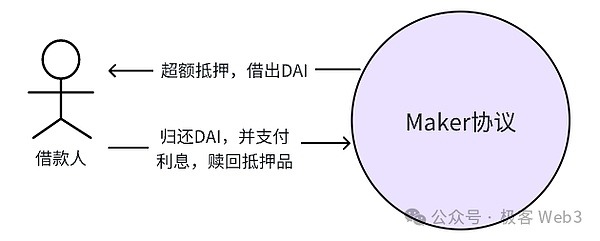

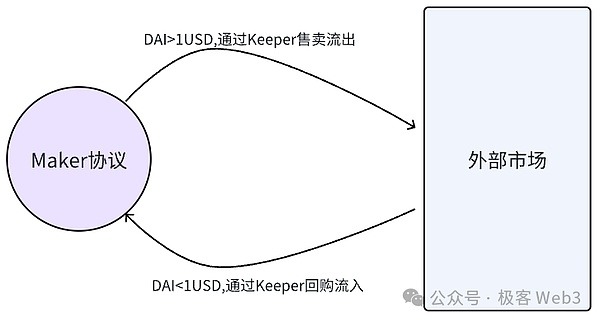

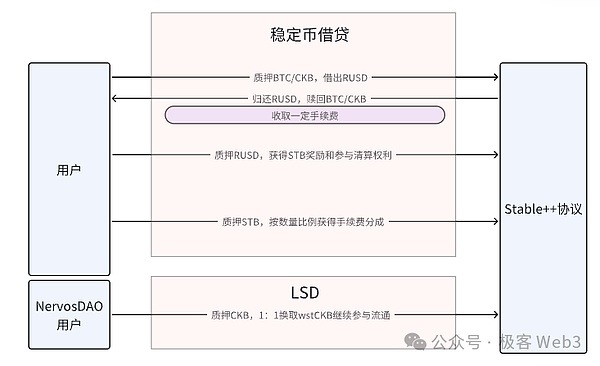

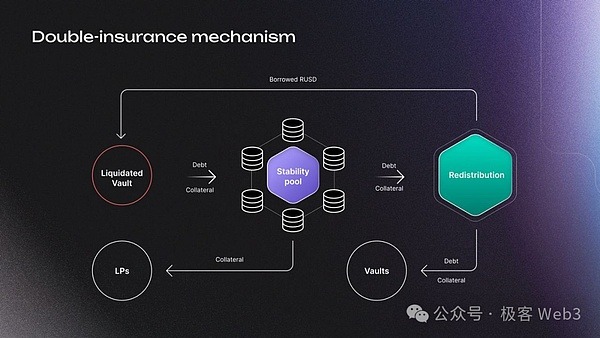

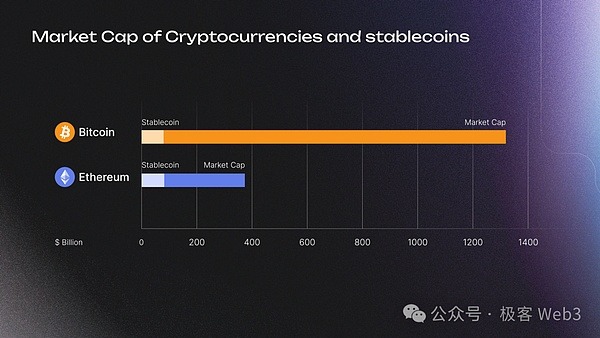

This article delves into Stable++, a groundbreaking CDP (Collateralized Debt Position) stablecoin protocol built on the CKB-based RGB++ Layer. Stable++ allows users to mint RUSD stablecoins by over-collateralizing with BTC or CKB. Unlike traditional CDP stablecoin protocols, Stable++ introduces innovative mechanisms: the Stability Pool and Redistribution, significantly enhancing liquidation efficiency and mitigating bad debt risks associated with market volatility.

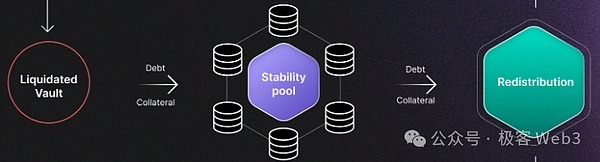

The Stability Pool acts as a readily available liquidation fund, ensuring swift processing of under-collateralized positions. The Redistribution mechanism steps in when the Stability Pool is insufficient to cover liquidations, distributing bad debt proportionally across all positions, thereby maintaining system stability. This dual approach forms a robust defense against cascading liquidations and systemic risk.

Furthermore, Stable++ supports isomorphic binding and Leap functionality, enabling seamless RUSD transfer between different blockchains. By integrating with CKB’s unique issuance mechanism, Stable++ contributes to building an underdamped system within the RGB++ ecosystem, mitigating market volatility and fostering healthy growth. This integration leverages CKB’s capacity for efficient and secure transactions, further enhancing the stability and reliability of RUSD.

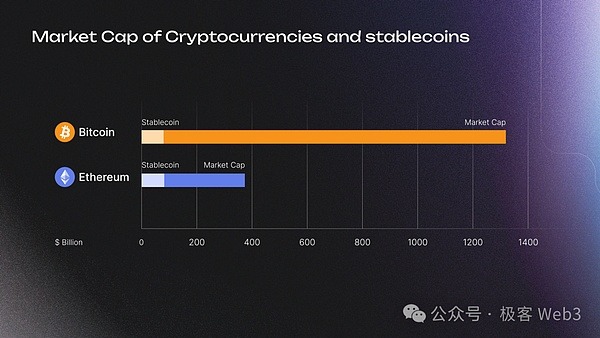

The author argues that Stable++, coupled with the ongoing development of the RGB++ Layer ecosystem, opens up new possibilities for the BTCFi landscape. It addresses the market’s demand for secure and reliable decentralized stablecoins and promotes increased utilization of BTC capital. The innovative combination of CDP, Stability Pool, and Redistribution represents a significant advancement in the design and stability of decentralized stablecoin protocols. The ability to seamlessly transfer RUSD between chains via isomorphic binding and Leap further strengthens its appeal and utility within the broader DeFi ecosystem.

However, potential challenges remain. The long-term effectiveness of the Redistribution mechanism under extreme market conditions requires further observation and analysis. The security of the Stability Pool and the mechanisms that govern its replenishment are critical factors in ensuring the ongoing stability of the RUSD stablecoin. Further research and audits will be needed to fully assess the robustness of Stable++ against various attack vectors and systemic risks. The performance of Stable++ under sustained market stress will be a key indicator of its success. The integration with the RGB++ Layer also depends on the continued growth and adoption of that ecosystem.