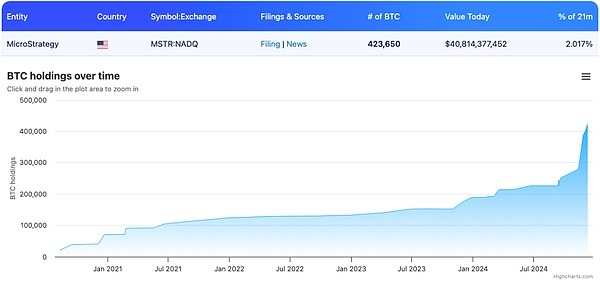

MicroStrategy’s recent purchase of 21,550 BTC, bringing its total holdings to 423,650 BTC at an approximate cost of $25.6 billion, has sparked considerable market discussion. Analyst Fred Krueger highlights the company’s strategy of using convertible debt financing to raise substantial capital through relatively low-priced stock issuances, allocating the entire proceeds to Bitcoin acquisitions. This maneuver has increased MicroStrategy’s net asset value per share, despite stock dilution. The anticipated appreciation of Bitcoin’s value leads to a rise in “satoshi per share” (“sats per share”), thereby potentially increasing the overall share value.

The article introduces a new Bitcoin unit, “Nakamoto,” representing 1.1 million BTC. The total holdings of current spot BTC ETFs have reportedly surpassed one Nakamoto. If MicroStrategy aims to accumulate one Nakamoto, it would require an additional 676,350 BTC, demanding roughly $64.9 billion in funding.

MicroStrategy’s approach hinges on the ability to continuously secure high-premium financing and maintain relative Bitcoin price stability. While uncertainty exists, MicroStrategy has cleverly leveraged the liquidity of the US stock market to achieve its massive Bitcoin accumulation goals. This strategy, however, is not without its risks. The continued success depends heavily on the future price of Bitcoin. A significant downturn in the Bitcoin market could severely impact MicroStrategy’s valuation, potentially leading to margin calls or other financial difficulties. The reliance on convertible debt financing also carries risks, as it dilutes shareholder ownership and increases financial leverage. The sustainability of this strategy in the long-term therefore depends on a confluence of factors, including continued Bitcoin price appreciation, consistent access to favorable financing terms, and the overall health of the broader financial markets. Future analysis should focus on evaluating the sensitivity of MicroStrategy’s strategy to these factors and the potential for alternative, less risky strategies. Furthermore, a comprehensive risk assessment encompassing potential regulatory changes, macroeconomic shifts, and technological advancements affecting the cryptocurrency market is crucial for a complete evaluation of MicroStrategy’s long-term Bitcoin investment strategy.